Named “Best Health Insurance Brand in Saudi Arabia” by Global Brands Magazine in 2022

Tawuniya health and takaful insurance plans are attentively and considerately designed to ensure any risks of financial hardship due to medical expenses are eliminated.

During the reporting period, Tawuniya’s health insurance division continued to successfully improve its efficiencies, speed, and quality of its claim processing by increasing the percentage of claims that are handled electronically, while encouraging customers to utilize electronic channels further.

In December 2020, Tawuniya partnered with SAS – the leader in analytics – to enhance fraud analysis and control for Tawuniya’s health insurance business line, by implementing an end-to-end Fraud Management system. Since its implementation, the system has helped in identifying, documenting, and responding to suspicious claims as well as fraud patterns and behavior, significantly speeding up the medical claim settlement process at Tawuniya.

2022 Highlights

A total of 324,805 new health insurance policies were purchased during the reporting period, resulting in a 27% sales growth across the business vertical. Of the total medical claims received in 2022, 97% were made electronically, a successful 8% year-on-year growth.

The total gross written premiums for Tawuniya’s health insurance business totaled SAR 9.9 Bn. for the year under review, with the business line contributing 69% of Tawuniya’s total revenue in 2022.

Tawuniya Vitality Program

Tawuniya pioneered a new era in the Saudi insurance industry by launching the industry’s first unique wellness program, Tawuniya Vitality in October 2020. The program helps policyholders understand their health status, and assists in adopting a healthier, more active, and rewarding lifestyle. It is the integration of smart technology, data, incentives, and behavioral science, with a highly engaging app that creates a customized wellness program which fit each customer’s needs. The program was launched in partnership with the Vitality Group, the global leader in wellness-based insurance with over 20 million members globally.

The Tawuniya Vitality program unlocks the power of positive reinforcement and active goal setting for customers, so that they can enjoy extended health benefits, as well as, incentives by cultivating healthier lifestyle habits such as good nutrition and exercise.

2022 Highlights

For the reporting period, data derived from the Tawuniya Vitality program recorded new highs; Vitality Members reaching the higher tiers of the program recorded an 18% reduction in claims per client, relative to members who did not participate in the Vitality program. The Company’s continuous promotion of the program to benefit members health during the year saw an 83% increase in Vitality memberships.

Personal/Individual Insurance Covers

My Family Medical Insurance Program

The program provides healthcare coverage to the nucleus of the Kingdom’s society, the family unit. In compliance with the provisions of Islamic Shariah, this cover consists of multiple categories to ensure inclusivity for all family members, extending across all levels of the community.

The family insurance covers a majority of medical services provided by outpatient, as well as, inpatient services, including the expenses for medical examination, diagnosis, medical treatment, medicine, vaccination, pre-existing diseases, pregnancy and maternity, with accessibility to the largest approved network of medical service providers in the Kingdom, which includes hospitals, medical centers, dispensaries, clinics, pharmacies, and optics shops.

Visit Visa Insurance

A product specifically designed to eliminate any sudden medical and financial risks for visitors to KSA, with a possible extension of the policy.

Tourist Insurance

In line with the decision of KSA to allow citizens of a number of countries to obtain Tourist Visa as of September 2019, Tawuniya launched the Tourist Insurance Program, to provide the highest standards of healthcare for emergency medical cases and accidents for tourists.

COVID-19 Risks Coverage Program

All visitors/tourists entering the Kingdom are required to purchase COVID-19 Risk Coverage, to cover all potential risks and medical / financial liabilities resulting from the infection of the Coronavirus while traveling in KSA.

Insurance Programs for Hajj and Umrah pilgrims

Tawuniya collaborates with participating insurance companies to provide Hajj and Umrah pilgrims with insurance covers, including Hajj general accident cover, Umrah medical cover and Umrah general accident cover, granting pilgrims safety and peace of mind during their holy journey.

Exclusive Value-Adding Services

In addition to all benefits provided by the policy, Tawuniya also offers a number of exclusive and value-adding services, including but not limited to:

- Medical reimbursement for treatment outside Tawuniya’s approved medical care network

- Chronic disease management

- Refill of chronic disease medication

- Eligibility letter confirming right to receive necessary treatment

- Home vaccination services for children aged between 0-7 years

- Embassy letter confirming the Saudi National holder has a valid insurance certificate while traveling outside the Kingdom

- Pregnancy follow-up program during all phases of pregnancy

Corporate Health Insurance Covers

Tawuniya offers distinctively designed medical insurance options for companies based on the number of employees and resulting number of coverages required. Tawuniya provides a number of benefits to Corporates through health insurance packages, including:

- Providing a single point of contact

- Easy online processing

- Cashless claims through a wide network of

a medical care network - Low cost premiums to encourage insuring larger numbers of employees

- Scalable plans tailored to cover companies of all sizes

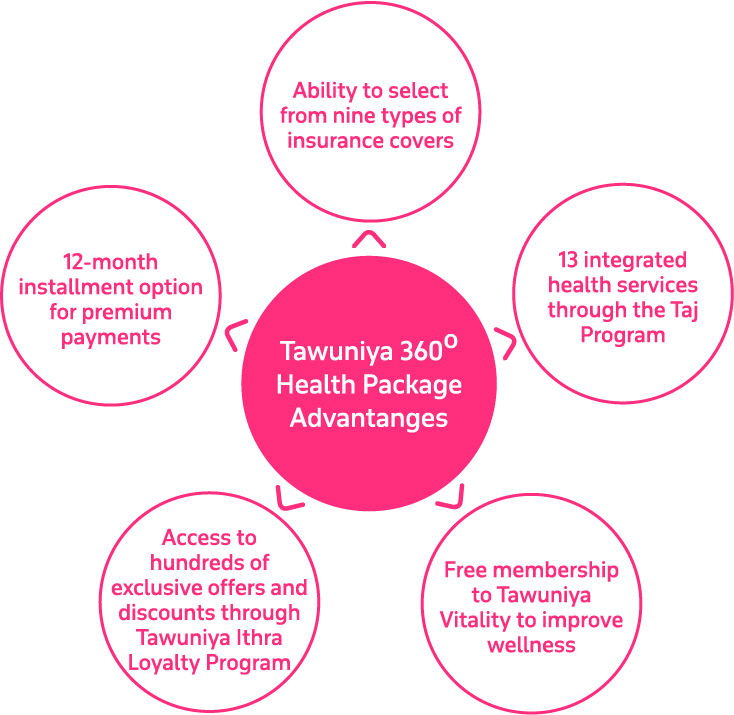

Small and Medium Enterprises (SMEs) – 360o Health Insurance

For corporates with less than 250 employees, Tawuniya offers a comprehensive, 360o insurance program that combines the benefits of the medical insurance policy for employees and their families, with a number of value-adding features including integrated health care and wellness monitoring, compatible with the requirements of the Kingdom’s Council of Health Insurance (CHI).

Mid-to-large corporates

For corporates with more than 250 employees, Tawuniya offers medical insurance and life insurance packages based on each company’s evolving needs, compatible with the requirements of the Kingdom’s Council of Health Insurance (CHI).

a. Compulsory Medical Insurance

Offers out-patient and in-patient medical expenses, with additional features for companies to update employee information and upgrade existing plans of employees as necessary.

b. Takaful Life Insurance

A program approved by the Shariah Authority, which reimburses the agreed benefit in the event of the loss of life of an employee of the insured institution or company. Employers can choose from a Group Life Plan or a Group Life Credit Plan, with the benefits ranging from the basic coverage benefit of mortality due to any cause, to other additional benefits including, but not limited to; critical illness, permanent, total or partial disablement due to accident or sickness, medical expenses as well as expenses for repatriation of mortal remains. Takaful also extends to Takaful Wafaa – Medical Limit Protection Plan, covering loss of life due to any cause beyond KSA borders.